You probably started your wedding photography business because you have a knack for capturing love and telling people’s stories. When you picked up a camera, you didn’t set out to become a business finance professional. Unfortunately, successfully running your business means you have to do a bit of both.

Business finances can feel overwhelming for creative types—ahem, wedding photographers—but these six business finance tips will help you get your business in shape, so bookmark this page and feel free to revisit it when you need a refresher.

First and foremost, owning your own business is hard. You’re doing it! So give yourself a high five. Then, let’s get to work on your finances with these business finance tips.

Tip 1. Separate Your Financial Accounts

If you haven’t opened a business bank account, start there. Seriously, go open one now and then come back. We’ll wait for you.

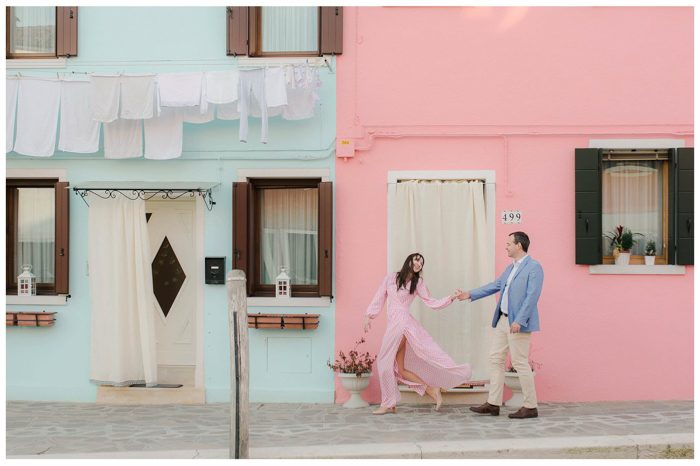

image by Fotis Sid

When you’re receiving money from your clients or paying your invoices, you should be using your business banking accounts. Mixing your personal and business accounts makes budgeting and tracking your profits really difficult. It also makes filing your taxes challenging.

Pay Yourself From Your Business Bank Account

Keep your business bank account separate—have we said this enough—and pay yourself from it. Setting up “paychecks” for yourself is the best practice and you’ll thank yourself during the off-season. Trust us.

We love the way that Tiffany Aliche from The Budgetnista lays this out in practice. Her advice is to treat your business account like a pot that all of your profits flow in and out of. Instead of seeing large invoices flow in and thinking you now have money to spend, keep them in that account. Then continue to pay your personal banking account in monthly increments. It takes practice, but practice makes perfect.

image by Daniel Lopez Perez

Tip 2. Save Your Receipts

Whether you’re meeting your clients for coffee or paying your annual software fees, save those receipts. Some countries (like the United States) will allow you to deduct those expenses on your taxes. Just make sure that you’re using cards connected to your business account.

If the thought of saving physical receipts is daunting—we’ve been there—snap a quick photo of it or request an email copy instead of a physical one. Then you can easily file them and access them at any time.

image by The Marvelous Pictures

Tip 3. Track Your Invoices

There’s no need to keep track of invoices in a fancy or expensive system when you’re first starting out. A Google sheet can help you get the hang of it. Make columns for your client’s name, email address, amount owed, and then follow-up dates. Luckily, as a wedding photographer you have a good negotiating chip—don’t send the full image gallery until your invoices are paid.

Clients that pay their invoices immediately are rare. It’s likely that you’ll need to remind many of them that they owe a balance. It can be uncomfortable asking for payments, but you can do it politely and still keep your client experience in mind.

image by Iskra Photo

Tip 4. Check Your Prices

Are you charging enough for your packages? An easy rule of thumb is if you’re fully booked and still getting inquiries, you can likely increase your prices. If you’re working with couples you enjoy and there’s a demand for your services, explore increasing your prices by 10%.

Increasing your prices by 10% may sound like a lot, but it’s not a noticeable difference to most of your clients. If you’re currently charging $1,000 for a wedding, a 10% increase will mean that you’re now charging $1,100.

How to Implement Price Increases

If you decide that you’re ready to level up your wedding photography packages and charge 10% more, you don’t necessarily need to announce it to the world. Grandfather in any current contracts at the current rates, update your pricing, and let any repeat clients know when they reach out to book.

image by Oliver Rabanes

Tip 5. Create a Budget

The word “budget” creates feelings of anxiety for many people so stay with us here. Don’t panic. Remember, a budget is simply a picture of money coming in and money going out. It’s not a grade of your business or a reflection of your skills. Think of it as taking a financial picture and you’re a professional wedding photographer—which you are.

If you’re already using software like QuickBooks, Honeybook, and even Google Sheets, you’ve got access to budget templates so take advantage of them. While creating this financial picture, be sure that you’re realistic about your cash flow, which is just another way of saying “your money coming in and your money that’s leaving.”

image by Fotomagoria

After creating your budget, make sure that you give yourself some cushion with extra cash reserves so you’ll have extra profits in case the wedding industry gets a little rocky—like we saw in 2020.

Make a Note of Essential and Non-Essential Expenses

Photo editing software? Definitely a must-have. First class flights to destination weddings? Not so much. If things do get a little rocky, those non-essential expenses should be the first thing you cut from your spending. It’ll be much easier to find those expenses and make those tough decisions once you’ve got your budget put together.

Tip 6. Ask for Help

Business finances don’t come naturally to everyone. Everything from how you were raised, what you studied in school, and even your parents’ relationship to money all impact your financial literacy. It’s okay to ask for help.

image by Simone Anne Photography

Beyond The Business Finance Tips

Running your own wedding photography business comes with many perks. Being your own boss, making your own schedule, and capturing love stories are certainly at the top of that list. Sure, there are the challenges of perfecting your Pinterest and managing your own business finances. But we’re here to help.

We hope these tips help get your wedding photography business finances in order. If you’re looking for more business tips, check out the Business Advice section of our website.